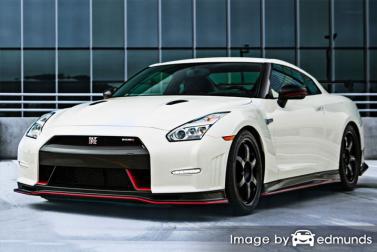

Trying to find more affordable Nissan GT-R insurance in Laredo is hard for people who have little experience buying insurance online. Drivers have so many agents and companies to choose from that it can turn into a burden to find cheaper Nissan GT-R insurance rates.

Trying to find more affordable Nissan GT-R insurance in Laredo is hard for people who have little experience buying insurance online. Drivers have so many agents and companies to choose from that it can turn into a burden to find cheaper Nissan GT-R insurance rates.

It’s an obvious assumption that auto insurance companies want to keep your business as long as possible. People who shop around for better prices are inclined to switch to a new company because they have good chances of finding a policy with more affordable rates. A recent study showed that drivers who regularly compared rates saved an average of $3,450 over four years compared to those who don’t regularly compare prices.

If finding the cheapest price on Nissan GT-R insurance is your ultimate goal, then learning about how to find companies and compare insurance rates can help simplify the process.

It is always a good idea to get comparison quotes as often as possible because insurance prices fluctuate regularly. If you had the best price on Nissan GT-R insurance in Laredo a year ago you will most likely find a better rate quote today. Forget all the misinformation about insurance because I’m going to let you in on the secrets to the only way to find the best coverage while lowering your premiums.

Low Cost Nissan insurance prices in Laredo

The car insurance companies shown below have been selected to offer price comparisons in Laredo, TX. In order to find the cheapest car insurance in Texas, we recommend you get prices from several of them to get the best price comparison.

Coverage analysis

The rate table below showcases detailed analysis of insurance premium costs for Nissan GT-R models. Being able to understand how insurance prices are calculated can be valuable when making decisions when shopping around.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| GT-R Premium AWD 2-Dr | $290 | $632 | $330 | $20 | $98 | $1,370 | $114 |

| GT-R AWD 2-Dr | $290 | $632 | $330 | $20 | $98 | $1,370 | $114 |

| Get Your Own Custom Quote Go | |||||||

Table data represents married female driver age 30, no speeding tickets, no at-fault accidents, $1000 deductibles, and Texas minimum liability limits. Discounts applied include multi-policy, homeowner, multi-vehicle, safe-driver, and claim-free. Rate information does not factor in garaging location in Laredo which can change rates significantly.

Rate increases following a ticket or accident

The chart below highlights how speeding tickets and at-fault accidents can increase Nissan GT-R annual premium costs for different age categories. The prices are based on a single female driver, comprehensive and collision coverage, $100 deductibles, and no discounts are applied to the premium.

Nissan GT-R insurance costs by gender and age in Laredo

The illustration below shows the difference between Nissan GT-R insurance costs for male and female drivers. The data is based on a clean driving record, no at-fault accidents, comp and collision included, $250 deductibles, marital status is single, and no additional discounts are factored in.

Car insurance policy discounts for Nissan GT-R insurance in Laredo

Some insurance providers don’t list every discount in an easy-to-find place, so the next list breaks down a few of the more common as well as some of the hidden credits available to lower your premiums when you buy Laredo auto insurance online.

- Early Switch Discount – Some car insurance companies provide a discount for renewing your policy before your current coverage expires. It can save you around 10%.

- Lower Rates for Military – Having a family member in the military could trigger a small discount.

- Drivers Ed for Students – Teen drivers should take driver’s ed class as it will make them better drivers and lower rates.

- Pay Early and Save – If you pay your bill all at once rather than paying in monthly installments you can avoid the installment charge.

- Theft Deterrent – Vehicles that have factory alarm systems and tracking devices are stolen with less frequency and can earn a small discount on your policy.

- Passive Restraints and Air Bags – Cars that have air bags and/or automatic seat belt systems may get savings of 25 to 30%.

- Discount for Life Insurance – Larger car insurance companies have a break if you buy life insurance.

- Anti-lock Brake Discount – Cars and trucks that have anti-lock braking systems can reduce accidents so companies give up to a 10% discount.

- Sign Online – Some car insurance companies provide a small discount simply for signing online.

- Federal Government Employee – Simply working for the federal government can earn a discount up to 10% but check with your company.

A little note about advertised discounts, most discount credits are not given to all coverage premiums. Most only cut the price of certain insurance coverages like liability and collision coverage. So despite the fact that it appears you could get a free car insurance policy, you aren’t that lucky. But all discounts should definitely cut the premium cost.

The diagram below illustrates the comparison of Nissan GT-R insurance costs with and without discounts being applied to the rates. The data assumes a male driver, a clean driving record, no claims, Texas state minimum liability limits, comprehensive and collision coverage, and $250 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with multi-policy, safe-driver, multi-car, homeowner, claim-free, and marriage discounts applied.

For a list of providers that offer many of these discounts in Laredo, click this link.

Informed Consumers Know How to Get Car Insurance Cheaper

A large part of saving on car insurance is knowing the rating factors that go into determining your car insurance rates. If you know what determines premiums, this helps enable you to make changes that can earn you lower car insurance prices.

Shown below are some of the factors used by your company to calculate rates.

- Can a thief steal your car? – Choosing a vehicle with a theft deterrent system can save you some money. Advanced theft deterrents such as GM’s OnStar, tamper alarm systems and vehicle immobilizers can thwart your car from being stolen.

- Increase deductibles and save – The deductibles you choose define the amount you are required to spend out-of-pocket if a covered claim is submitted. Physical damage coverage, also known as collision and other-than-collision, insures against damage to your car. Some coverage claims are rear-ending another vehicle, vandalism, and having a roll-over accident. The more expense the insured is willing to pay, the lower your rates will be.

- Save money by having multiple policies – Most major insurers provide a discount to insureds who have multiple policies with them in the form of a multi-policy discount. The discount can be as much as ten percent or more Even if you already get this discount, it’s still a good idea to compare other company rates to make sure you are getting the best deal. It’s possible to still save more without the discount by buying car insurance from a different company.

- Premiums and job – Did you know your occupation can influence how much you pay for car insurance? Careers such as lawyers, airline pilots, and emergency personnel generally have higher premiums than the average policyholder due to job stress and long work hours. Conversely, careers such as actors, historians and the unemployed pay lower than average rates.

- Reduce premiums by driving safer cars – Vehicles with high crash test scores tend to be cheaper to insure. Vehicles built for safety result in less severe injuries and lower injury rates means less money paid by your insurance company and more competitive rates for policyholders. If your Nissan GT-R is rated at a minimum an “acceptable” rating on the Insurance Institute for Highway Safety website or four stars on the National Highway Traffic Safety Administration website you may pay a lower rate.

- File car insurance claims and pay more – If you tend to file frequent claims, you can expect higher rates. Auto insurance companies in Texas generally give the lowest premiums to drivers that do not abuse their auto insurance. Insurance coverage is intended to be relied upon for major claims that would cause financial hardship.

-

Insurance loss statistics a Nissan GT-R – Insurers study historical loss data as a tool for profitable underwriting. Vehicles that have a trend towards higher claims will be charged more to insure.

The table below outlines the collected loss data for Nissan GT-R vehicles. For each policy coverage type, the loss probability for all vehicles, as a total average, is equal to 100. Values under 100 suggest a better than average loss history, while values that are 100 or greater indicate a higher chance of having a claim or an increased chance of a larger loss.

Nissan GT-R Insurance Claim Statistics Vehicle Make and Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Nissan GT-R 2dr 4WD 373 82 317 BETTERAVERAGEWORSEEmpty fields indicate not enough data collected

Statistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

You are unique and your insurance should be too

When it comes to buying a policy, there isn’t really a cookie cutter policy. Each situation is unique and your insurance should be unique as well.

For instance, these questions could help you determine if your situation will benefit from professional help.

- Can I insure my car for more than it’s worth?

- When do I need to add a new car to my policy?

- Is coverage enough to protect my assets?

- Should I buy only the required Texas minimum liability coverage?

- Is motorclub coverage worth it?

- Can I get a multi-policy discount?

If you’re not sure about those questions but you think they might apply to your situation, you might consider talking to an insurance agent. If you want to speak to an agent in your area, complete this form or go to this page to view a list of companies.

Exclusive and independent insurance agencies

Some consumers still like to go talk to an agent and that is not a bad decision One of the benefits of price shopping on the web is you can get better rates but also keep your business local. And buying from local insurance agencies is still important in Laredo.

For easy comparison, once you complete this form (opens in new window), your coverage information is sent to companies in Laredo that can give you free Laredo auto insurance quotes to get your business. You won’t even need to find an agent on your own because quoted prices will be sent to you directly. You can find better rates without a big time investment. If you want to compare rates from one company in particular, don’t hesitate to visit that company’s website and complete a quote there.

For easy comparison, once you complete this form (opens in new window), your coverage information is sent to companies in Laredo that can give you free Laredo auto insurance quotes to get your business. You won’t even need to find an agent on your own because quoted prices will be sent to you directly. You can find better rates without a big time investment. If you want to compare rates from one company in particular, don’t hesitate to visit that company’s website and complete a quote there.

Below is a short list of insurers in Laredo that may be willing to give rate quotes for Nissan GT-R insurance in Laredo.

- J.J. MARTINEZ INSURANCE AGENCY

2101 Springfield Ave – Laredo, TX 78040 – (956) 723-7480 – View Map - Kike Trevino – State Farm Insurance

517 Shiloh Dr #4 – Laredo, TX 78045 – (956) 791-5453 – View Map - Farmers Insurance – Rene Benavides

8218 Casa Verde Rd, A-5 – Laredo, TX 78041 – (956) 723-9511 – View Map - Cubriel Insurance LLC

1808 Commerce Dr – Laredo, TX 78041 – (956) 568-5290 – View Map

Finding the right insurance company should depend on more than just the quoted price. You should also get answers to these questions.

- Which insurance companies are they affiliated with?

- Do they review policy coverages at every renewal?

- Do they have a Better Business Bureau rating in Laredo?

- What will you get paid if your car is a total loss? How is that amount determined?

- Can they help ensure a fair claim settlement?

- Can you use your own choice of collision repair facility?

If you get satisfactory answers and locked in a price quote, you may have just found an insurer that is professional and can adequately provide auto insurance.

Frequent quotes can save

When searching for cheaper Laredo auto insurance quotes, never skimp on coverage in order to save money. There have been many situations where drivers have reduced comprehensive coverage or liability limits and learned later that their decision to reduce coverage ended up costing them more. The ultimate goal is to purchase plenty of coverage for the lowest cost but still have enough coverage for asset protection.

The cheapest Nissan GT-R insurance in Laredo can be sourced both online and from local agencies, so you should be comparing quotes from both to have the best rate selection. Some insurance companies may not have rates over the internet and most of the time these small, regional companies prefer to sell through independent agencies.

How to find better rates for Nissan GT-R insurance in Laredo

It takes a few minutes, but the best way to quote cheaper Nissan GT-R insurance in Laredo is to regularly compare prices from insurers in Texas. Price quotes can be compared by following these guidelines.

First, try to learn about how companies price auto insurance and the modifications you can make to prevent high rates. Many rating factors that result in higher rates like speeding tickets, careless driving and a not-so-good credit rating can be amended by making small lifestyle or driving habit changes.

Second, compare prices from independent agents, exclusive agents, and direct companies. Direct and exclusive agents can provide rates from one company like Progressive and State Farm, while independent agencies can provide rate quotes for many different companies.

Third, compare the new rate quotes to the premium of your current policy to see if switching to a new carrier will save money. If you find a lower rate quote and make a switch, make sure there is no coverage gap between policies.

A good tip to remember is to make sure you enter identical coverage information on each price quote and and to get prices from as many auto insurance providers as possible. Doing this enables a fair rate comparison and a complete selection of prices.

Other information

- Distracted Driving (Insurance Information Institute)

- What Car Insurance is Cheapest for Retired Military in Laredo? (FAQ)

- Who Has the Cheapest Auto Insurance for a Learners Permit in Laredo? (FAQ)

- Uninsured Motorists: Threats on the Road (Insurance Information Institute)

- Higher speed limits cause more fatalities (Insurance Institute for Highway Safety)

- Preventing Carjacking and Theft (Insurance Information Institute)

- Choosing a Car for Your Teen (State Farm)