Unfortunately, a large majority of drivers have purchased from the same company for more than four years, and 38% of customers have never compared rates to find affordable insurance. Many drivers in Laredo could save nearly $1,800 each year by just comparing rate quotes, but they don’t want to spend time to compare rate quotes.

Unfortunately, a large majority of drivers have purchased from the same company for more than four years, and 38% of customers have never compared rates to find affordable insurance. Many drivers in Laredo could save nearly $1,800 each year by just comparing rate quotes, but they don’t want to spend time to compare rate quotes.

If saving money is your primary concern, then the best way to find the cheapest price for car insurance rates is to start comparing prices regularly from insurers in Laredo.

- Try to understand car insurance and the modifications you can make to prevent expensive coverage. Many rating criteria that increase rates like traffic violations and an unfavorable credit rating can be eliminated by improving your driving habits or financial responsibility. This article provides instructions to keep prices down and find discounts that may have been missed.

- Request price quotes from direct carriers, independent agents, and exclusive agents. Exclusive and direct companies can give quotes from one company like Progressive or State Farm, while independent agencies can provide prices for a wide range of insurance providers.

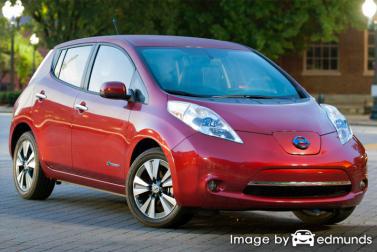

- Compare the new quotes to your existing rates to see if cheaper Leaf coverage is available in Laredo. If you find a better price and switch companies, verify that coverage does not lapse between policies.

One thing to point out is to try to compare identical limits and deductibles on each quote request and and to compare as many car insurance companies as possible. Doing this enables a fair price comparison and the best price quote selection.

The companies in the list below have been selected to offer free rate quotes in Laredo, TX. To buy the cheapest auto insurance in Laredo, we suggest you get rate quotes from several of them to get the best price comparison.

How You Can Control Nissan Leaf Insurance Premiums

Lots of things are part of the equation when you get your auto insurance bill. Some of the criteria are obvious like a motor vehicle report, but some are not quite as obvious such as whether you are married or how safe your car is. The best way to find cheaper insurance is to take a look at the rating factors that aid in calculating the rates you pay for insurance. If you know what controls the rates you pay, this enables informed choices that may result in lower insurance prices.

The factors shown below are some of the most rate-impacting factors used by insurance companies to determine your rates.

Insurance rates are higher for high performance vehicles – The performance of the car, truck or SUV you are insuring makes a substantial difference in how high your rates are. Small economy passenger vehicles receive the most favorable rates, but other factors influence the final cost greatly.

Amount of liability coverage – Your policy’s liability coverage will protect you if you are found liable for an accident. Liability insurance provides legal defense to attempt to prove you were not liable. Carrying liability coverage is mandatory and cheap compared to other policy coverages, so drivers should carry high limits.

Single drivers take more risk – Walking down the aisle actually saves money compared to being single. It is viewed as being more responsible and statistics prove married drivers tend to file fewer claims.

Drive less and get lower costs – The more you drive each year the more you’ll pay to insure your vehicle. The majority of insurers calculate rates based upon how you use the vehicle. Cars used primarily for pleasure use qualify for better rates than cars that get driven a lot. It’s a smart idea to ensure your insurance policy properly reflects the proper vehicle usage. An incorrectly rated Leaf can result in significantly higher rates.

Driving citations will cost you – Attentive drivers tend to pay less for car insurance than bad drivers. Even a single chargeable violation could increase your next policy renewal twenty percent or more. Drivers who have serious violations like DWI, reckless driving or hit and run convictions may find that they have to to prove financial responsibility to the state department of motor vehicles in order to drive a vehicle legally.

Claims statistics for a Nissan Leaf – Insurers take into consideration insurance loss statistics for every vehicle to help calculate a profitable premium price. Models that are shown to have higher loss trends will have higher rates.

The next table illustrates the insurance loss data used by companies for Nissan Leaf vehicles. For each policy coverage, the claim amount for all vehicles combined as an average is represented as 100. Numbers shown that are under 100 mean the vehicle has better than average losses, while values that are above 100 point to more claims or an increased chance of larger losses than average.

| Vehicle Make and Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Nissan Leaf Electric | 89 | 84 | 45 | 83 | 64 | 76 |

Data Source: iihs.org (Insurance Institute for Highway Safety) for 2013-2015 Model Years

Three reasons to not skimp on insurance

Despite the high cost, insurance is required in Texas but also provides important benefits.

- Almost all states have minimum mandated liability insurance limits which means it is punishable by state law to not carry a minimum amount of liability insurance coverage in order to be legal. In Texas these limits are 30/60/25 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If you took out a loan on your vehicle, almost every bank will require you to have physical damage coverage to guarantee payment of the loan. If you do not keep the policy in force, the bank will be required to insure your Nissan at an extremely high rate and force you to reimburse them for the much more expensive policy.

- Insurance protects both your Nissan and your assets. It will also reimburse you for most medical and hospital costs for you, your passengers, and anyone else injured in an accident. As part of your policy, liability insurance will also pay to defend you if you cause an accident and are sued. If damage is caused by hail or an accident, your insurance policy will cover the repair costs.

The benefits of carrying enough insurance definitely exceed the price paid, especially when you need to use it. According to a recent study, the average American driver is overpaying more than $855 a year so compare rates at every policy renewal to ensure rates are competitive.

Best auto insurance in Texas

Picking the best car insurance provider can be a challenge considering how many companies there are to choose from in Laredo. The ranking information listed below can help you choose which auto insurers to look at purchasing a policy from.

Top 10 Laredo Car Insurance Companies Overall

- Travelers

- USAA

- Mercury Insurance

- AAA Insurance

- Nationwide

- Allstate

- State Farm

- The Hartford

- Safeco Insurance

- Progressive